- Solana bounce back stalls.

- Solana blockchain failures arouse concern.

- Solana outlook still positive

Solana was one of the best performing cryptocurrencies in 2021, rallying by more than 8,000% to record highs of about $254. However, as the year came to a close, cracks started to appear at the back of significant blockchain failures. The result was the coin coming under pressure as investors started locking in profits following the meteoric rise.

Solana’s technical analysis

A broad market sell-off all but accelerated the sell-off resulting in the cryptocurrency shedding a significant market value. The coin is down by about 60%, year to date from record highs reached in November.

The pullback appears to have gathered pace in 2022, with the coin already down by about 40% year to date. The pullback has coincided with a broad market correction that has seen high-profile coins led by Bitcoin and Ethereum shedding a significant amount of market value from record highs. The sell-off was exacerbated by investors shunning riskier assets amid escalating inflation levels and the Federal Reserve hinting of accelerated monetary policy tightening.

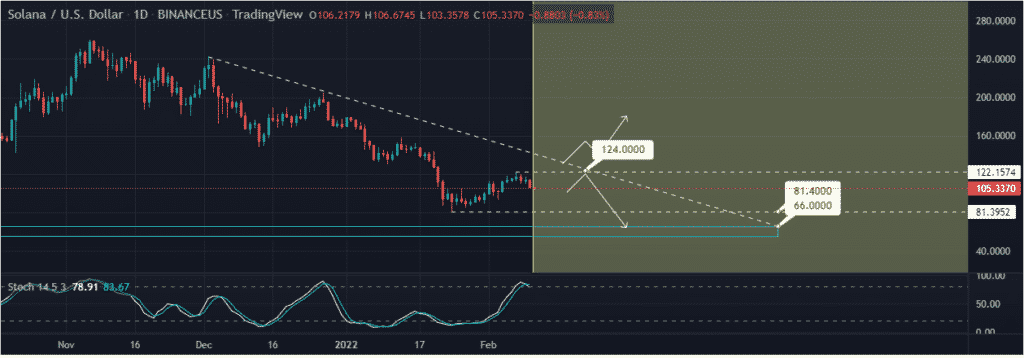

After correcting to five-month lows of about $80, a coin SOLUSD did bounce back. However, the bounce back appears to have hit resistance near the $120 level. The pair has since started edging lower, with bulls appearing to be exited.

The ongoing pullback faces support near the $96 level, below which the sell-off could accelerate back to lows of about $80. SOL bulls need to defend the $100 level to avert further sell-offs back to six-month lows.

Solana’s edge

Solana, which came into being in 2020, has risen to become the seventh-largest cryptocurrency by market cap. The rise to dominance might as well be attributed to Solana’s blazing transaction speeds as well as an active development team.

Solana’s edge in the payment business stems from its blockchain handling 50,000 transactions per second, way much higher compared to just 15 for Ethereum. The fast transaction speeds stem from the blockchain project leveraging the proof of history consensus mechanism, which marks data blocks with timestamps, enhancing the validation process.

Blockchain failures

Amid the high transaction speeds, Solana sentiments in the market have come under pressure due to many issues that have destroyed the project. Last month, its blockchain suffered a major outage as duplicate transactions arose, consequently congesting the network. Developers resolved the issue by integrating new improvements over the next 8-12 weeks.

Things, however, got from bad to worse as blockchain failures continue to arouse concern about the project. Reports that Solana lost close to $320 million worth of Ethereum from its Decentralized Finance token bridge is the latest headwind that threatens to sour its sentiments in the market.

It has since emerged that attackers essentially took advantage of exploits in the bridge between Solana and Ethereum. In return, they ended up minting 120,000 ETH and bridged 10,000ETH. The incidence has affirmed how dysfunctional some blockchains could be despite being touted for their security edge.

Solana outlook

Amid the blockchain failures, Solana remains a firm favorite which explains the recent bounce back from five-month lows. Its adoption has grown steadily over the past year, affirming strengthened user confidence and investor interest in the market.

That said, the prospect of SOLUSD finding support above the $100 level and edging higher is still high. Consequently, a bounce back to the $200 a coin level could be on the cards before year-end. However, the speculating nature of cryptocurrencies also means SOLUSD could remain under pressure and continue edging lower in line with the recent deep pullback.