Stealth Trader uses Metatrader 4 platform to trade currencies 24/7. It comes with three different live trading accounts and backtesting stats. The developer recommends the traders try the demo version before going for the big fish. Free lifelong updates and one month money-back policy are also available with the purchase. Our review will analyze all the aspects of the expert advisor and test its integrity with different parameters.

Is investing in Stealth Trader a good decision?

The data available on the official page of the robot focuses more on convincing the traders that they are not scammers. The presentation lacks technical aspects. To determine its true performance we have gone through its live and backtesting records and all the available features.

Company profile

The parent company of the Stealth Trader is LeapFX, and Greg James is the developer of this trading tool. Other than the biography of the vendor, no information such as certifications, location of their office, etc., are not provided. Multiple client testimonies are present on different third-party platforms such as Forex Peace Army, with a total rating of 3.196 out of 5.

Main features

Following are the main feature of the expert advisor:

- The developer offers a refund policy for 30-days.

- The system doesn’t use the grid/martingale strategy.

- It is compatible with all types of accounts.

- 24/7 customer service.

- Free lifetime updates.

- Detailed user manual for easy installation.

Strategy

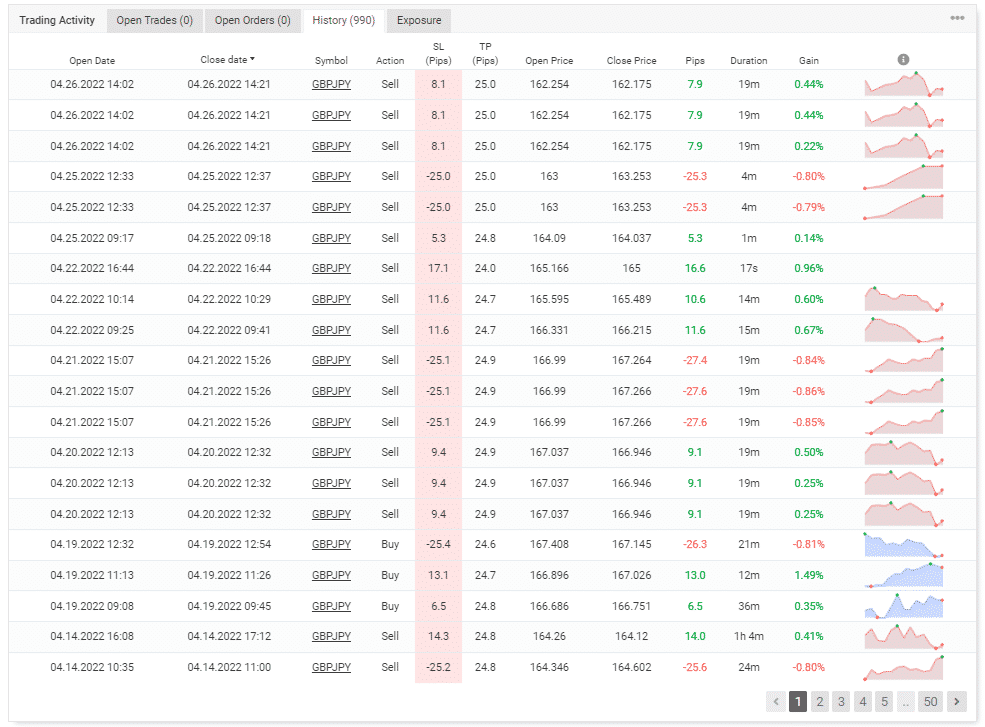

There is no clear information about the strategic approach of the EA. The only thing mentioned by the developer is that it works on GBPJPY currency pair, can trade with any account size, and doesn’t use a grid/martingale strategy. The vendors forgot to tell the clients about compatible brokers, indicators, timeframe, strategies, and money-management features. The developer claims that the robot doesn’t use the grid and martingale strategy, but the trading record contradicts that statement.

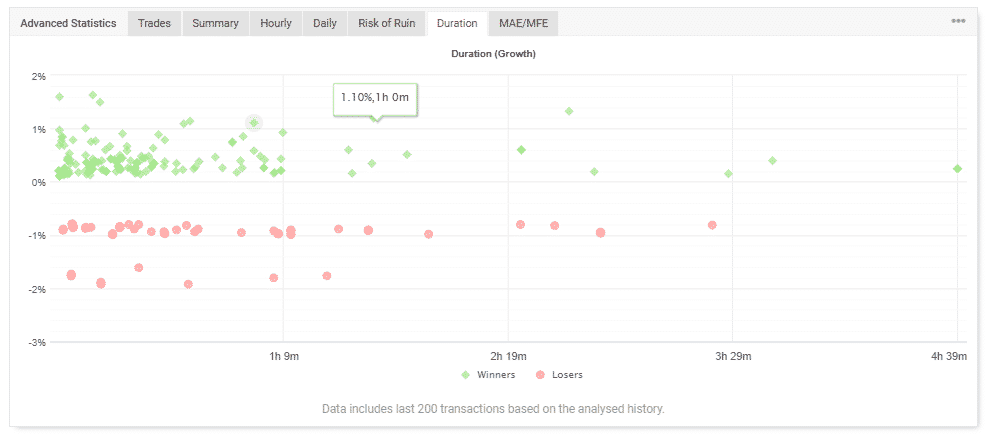

MYfxbook history shows us that the algorithm uses averaging with the most trades closing within an hour. There is no fixed time for the system to place trades.

Price

The algorithm comes with two pricing packages; yearly membership can cost up to $347, and a lifetime offer with $597. The purchase comes with the original copy of the robot, customer support, lifetime updates, and a 30-day money-back policy. The asking price of the expert advisor seems overpriced as you can find affordable and high-performance solutions at a lower cost.

Trading results

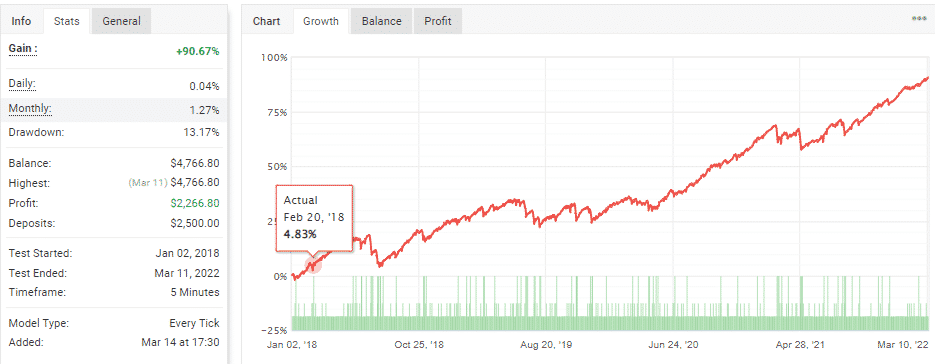

M5 timeframe backtesting stats are available on the GBPJPY from 2018.01.02 to 2022.03.11. The three-year duration of backtesting records may not be enough to analyze the profitability of the robot on historical data.

The total gain of the system was seen as +90.67, with the total balance of the account at $4766.80. The value of absolute drawdown was 13.17%, and the standard deviation value at $21.66. The worst trade is shown to be -$86.96, with a profit factor of 1.36.

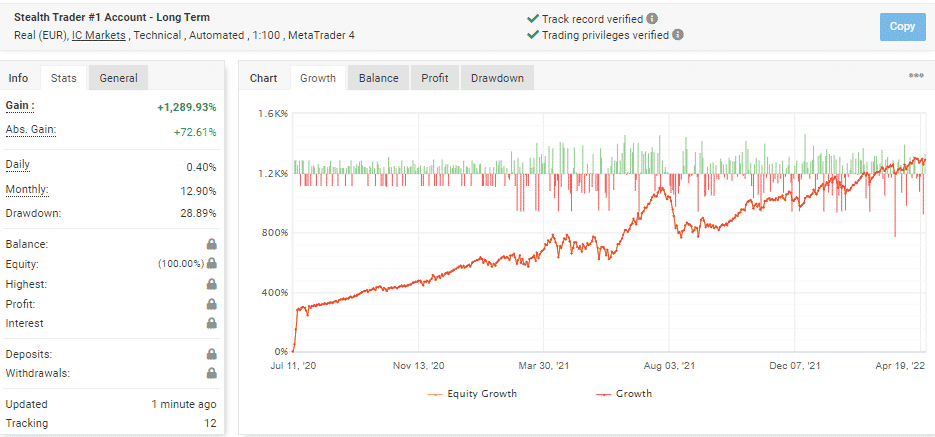

Verified live track records of Stealth Trader are available on Myfxbook. The account started trading on 14 March 2020 and uses the 1:100 leverage. The profit factor is 1.36 similar to the backtesting records, with a total gain of +1289.93%.

“A half-truth is a whole lie” is a well-known proverb. The developer didn’t disclose many parts of the live trading record, such as initial deposit, equity, net profit, lots, etc. There is something they want to hide from the traders.

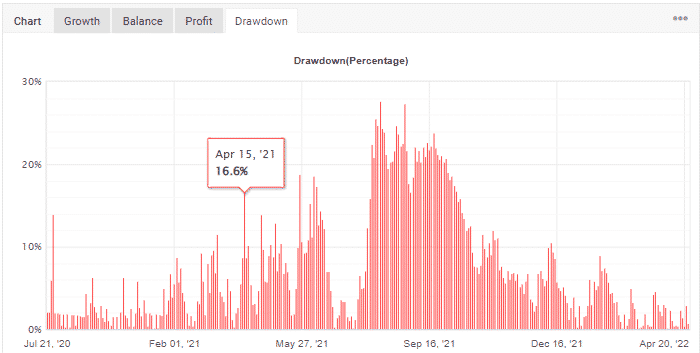

The average drawdown value of the system stood at 28.89%, which shows that the EA is taking a slightly risky strategical approach to place trades.

Customer reviews

Unfortunately, no customer reviews can be found about Stealth Trader, but a few comments are available on Forexpeacearmy, Trustpilot, etc., about the parent company Leapfx.

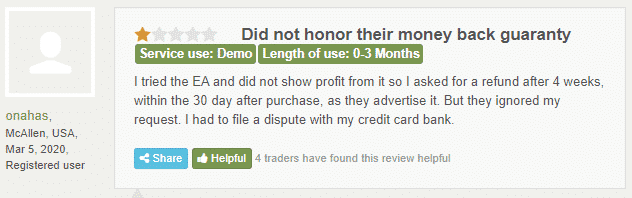

A customer testimony highlighted the story about how he struggled to get him his money back when he claimed the refund policy. The developers did not honor their promises and ignored his request deliberately.

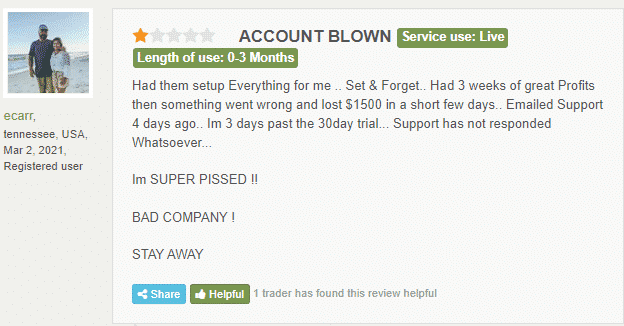

Another user gave his feedback while explaining how he got pissed when his account got blown. He added that the customer support didn’t respond and advised fellow traders to stay away from this company.

Stealth Trader summary

The short duration of backtesting records and disclosure of little data on live trading records raises concerns over the credibility of the EA. The overpriced cost and the failure of the developer to provide clear information about the robot’s strategy are also some red flags. Moreover, vendor transparency and negative user feedback cannot be ignored before investing in this algorithm.