Tiburon EA is available on the MQL5 marketplace for $199. The algorithm trades using a custom indicator from the developer that identifies the overbought and oversold areas on the chart. It is possible to use custom risk management using the auto lot feature. To identify if the features offered by the system are good enough for our portfolio, we will review them in our article.

Is investing in Tiburon EA a good decision?

The algorithm is currently using averaging and martingale strategies to trade the market. It has been live for a short duration, which is not enough to classify it as a good investment choice.

Company profile

Elizaveta Erokhina is the author of the EA. She resides in Russia and has a total rating of 5 for 4 reviews. The developer has 4 products published on the MQL5 marketplace and has 29 subscribers for her services. The MQL5 website dictates that the developer does not have any trading experience in the market.

Main features

The robot comes with the following main features:

- Auto lot money management is available.

- It uses a dynamic take profit feature.

- It is compatible with any broker.

- The system is user friendly.

To install the EA, use the following steps:

- Purchase the system from the developer at the MQL5 marketplace

- Login to your MT4/5 account at the platform

- Download the robot

- Attach the EA to charts to start trading

Strategy

The developer states that the EA trades on EURUSD at the H1 time frame and uses stochastic and RSI to identify possible price change at definite levels. It also uses a custom indicator from the author, which captures the overbought and oversold levels. With the combination of the following signals, the robot filters out all the negative signals in the market.

From the history of the MQL5 records, we can observe grid and martingale strategies. The lot size after a trade goes into a loss increase by the increment of 0.01.

Price

The robot is available for an asking price of $199. There are also options to rent it for one month at $100. There is no money-back guarantee available.

Trading results

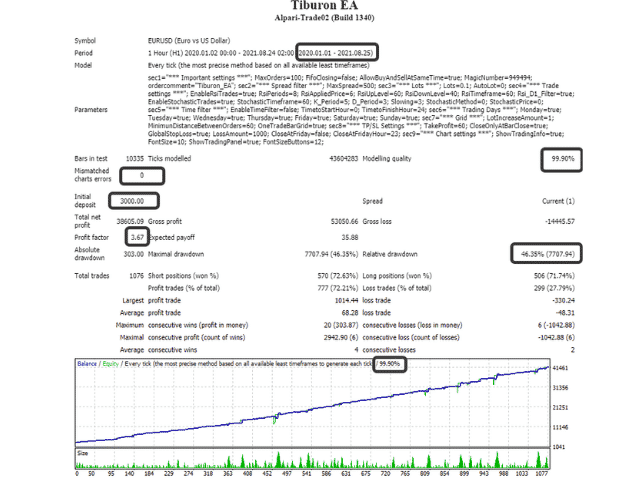

Backtesting results are available for EURUSD at the H1 chart where the relative drawdown was around 46.25%. The winning rate was 72.21%, with a profit factor of about 3.67. The test was done with a starting balance of $3000, where the robot tanked an average profit of $38605.09. There were 1075 trades in total in which the best trade was $1814.44, while the worst one was -$330.24.

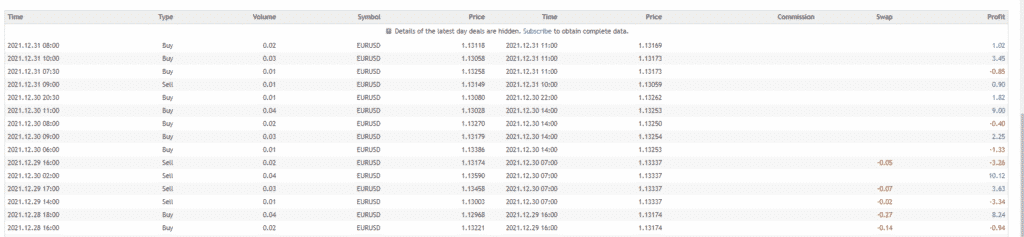

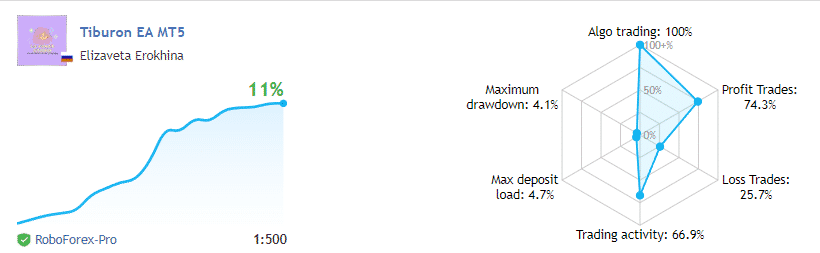

Verified trading records are available on MQL 5. We have a performance from December 27 2021, till the current date. The system made an average monthly gain of 10.54% for the period, with a drawdown of 4.1%. The winning rate stood at 74.3%, with a profit factor of 9.44. The best trade was $21.96, while the worst was -$3.36 in 35 trades.

Customer reviews

General customer reviews are available on the MQL 5 marketplace, which gives the robot a total rating of 5 for a single feedback. The trader says that he ran the EA through the volatile news events, and it was ok.

Summing up

Tiburon EA uses risky grid and martingale strategies that can cause a high drawdown on the account if the market chooses to trend in one direction. The developer is unclear on the backtesting records and presents live records for a short duration.