The laymen may be wondering, what exactly is a cryptocurrency? Despite being a tricky idea to consider initially, with some further reading, understanding these kinds of currencies becomes simpler. After this stage, one should appreciate just how significant they are in the world.

Cryptocurrencies have been the buzzword, at least for the last five years, in the financial industry. Despite continually facing negative reception from so-called experts and being labeled terms such as ‘pyramid scheme’ and ‘bubble,’ it seems as though the invention is here to stay.

Some people may wonder what exactly a cryptocurrency is. Rightfully so, these currencies are a different beast altogether. Digital currencies make for engaging learning about how money is becoming presently and might be in the future.

Definition of a cryptocurrency

A cryptocurrency is a digital currency where a distributed ledger secured by robust cryptography stores its records. One of the critical facets of any cryptocurrency is cryptography that enables the creation of new coins and storage of transactions.

The second essential attribute is decentralization, where no central authority, like a government or central bank, has power. Instead, this power is distributed amongst the people using the system. Analysts trace the origin of cryptocurrencies as far back as the mid-80s through the visions of several cypherpunks.

Cypherpunks are highly educated and intelligent individuals who advocate for cryptography and privacy-centric technologies. These two features are some of the main pillars of cryptocurrencies.

Despite numerous digital cash technology concepts, Bitcoin became the first successfully launched cryptocurrency in 2009 created by the mysterious individual or group known as Satoshi Nakamoto. Since then, Bitcoin and other cryptocurrencies have spearheaded an unprecedented financial revolution.

Blockchain

One of the central features of most cryptocurrencies is the system used for transaction records. The most commonly utilized is a distributed ledger technology known as the blockchain. Satoshi Nakamoto often receives much of the credit for this concept.

A blockchain is a cryptographic and continuous trail of ‘blocks’ in a peer-to-peer network that contain bits of transaction data. The purpose of a blockchain is that since it’s decentralized and often publicly available, no computer can alter any single block without altering all others (making it highly robust, although not wholly immutable).

Once the code written in the blockchain confirms a block, it becomes unalterable and permanent. How transactions are secured depends on what is known as the consensus mechanism. Most cryptocurrencies are relying on blockchain technology employ mining through proof-of-work and proof-stake consensus mechanisms.

Mining

An integral part of the blockchain is mining, which is the action of ‘miners’ utilizing advanced computers to solve complex hash functions for a block. Whichever individual or group is first to achieve the calculation is given the right to add the block and receive a reward based on the coded rules.

This mining example is one of the most common, known as proof-of-work. Another notable mechanism is proof-of-stake, where the blockchain automatically picks an individual or group to receive the block reward based on the amount they’ve staked beforehand.

Characteristics of cryptocurrencies

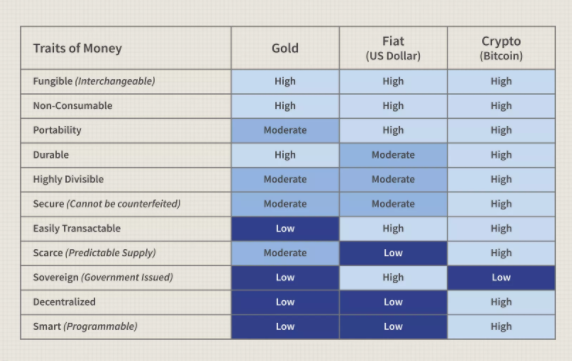

Appreciating the attributes of cryptocurrencies necessitates looking at the forms of money we already know. If we see the table above, we can observe cryptocurrencies come out on top for every aspect.

At their core, cryptocurrencies are, well, cryptic by design because no individual or entity can theoretically control or create a counterfeit (low sovereignty, decentralized, secure). Cryptocurrencies are programmable and continuously updated.

Since they are digital, they tick the ‘portability’ and ‘durability’ boxes as no physical coins need to exist, a far better proposition than hard cash. Being an electronic medium of exchange makes them easily transactable (can be sent internationally quickly) and fungible (interchangeable).

As a unit of account, cryptocurrencies are highly divisible as we can receive minute denominations of it, as small as ten places after the decimal (in some cases). Lastly, creators of digital currencies meant for them to be scarce as most have a finite supply, making them increasingly valuable and inflationary.

Main uses of cryptocurrencies

Cryptocurrencies have exemplified several unprecedented gains for users and investors. At their core, like fiat currencies, a cryptocurrency is a decentralized digital medium of exchange, but faster, cheaper, and mostly anonymous.

The list of merchants accepting popular digital currencies is growing. With the introduction of altcoins like Ethereum, cryptocurrencies are now used on specific platforms to pay developers.

Decentralized applications allow benefits such as loaning money using cryptocurrencies, earning attractive interest rates in a savings account, and storing anything of value using smart contracts, among other things.

More significantly, cryptocurrencies offer diverse opportunities for investment purposes. Mining allows anyone to earn additional coins that are convertible to fiat money. Some cryptocurrencies enable the holders to stake their coins to gain more of them.

As with any financial instrument, cryptocurrencies continue to be the subject of keen speculation through ‘buy and hold’ or hedging against inflation. The scope of what we can use cryptocurrencies for is still in its infancy.

Why are cryptocurrencies valuable?

Millions of investors are avid speculators of cryptocurrencies but may not necessarily understand what makes them valuable. The reasons have to do with the fundamental attributes of money.

Economists believe that money should do three things:

- Act as a medium of exchange

- Act as a unit of account

- Act as a store of value

As a medium of exchange, cryptocurrencies excel in this regard by being digital, portable, interchangeable, easily transactable, and ultimately cheap in transaction cost.

As a unit of account, we can divide a cryptocurrency into several thousandths (or even smaller), ensuring a highly accurate value calculation.

The merits of cryptocurrencies are undeniable as they have disrupted the financial sector and given millions of people incredible options for growing and storing their money. Aside from the reasons above, cryptocurrencies are like the ‘digital gold’ in being a scarce commodity that, by design, only has a limited supply.

Basic laws of economics state that when the supply is low, the demand rises, consequently increasing value.

Examples of well-known cryptocurrencies

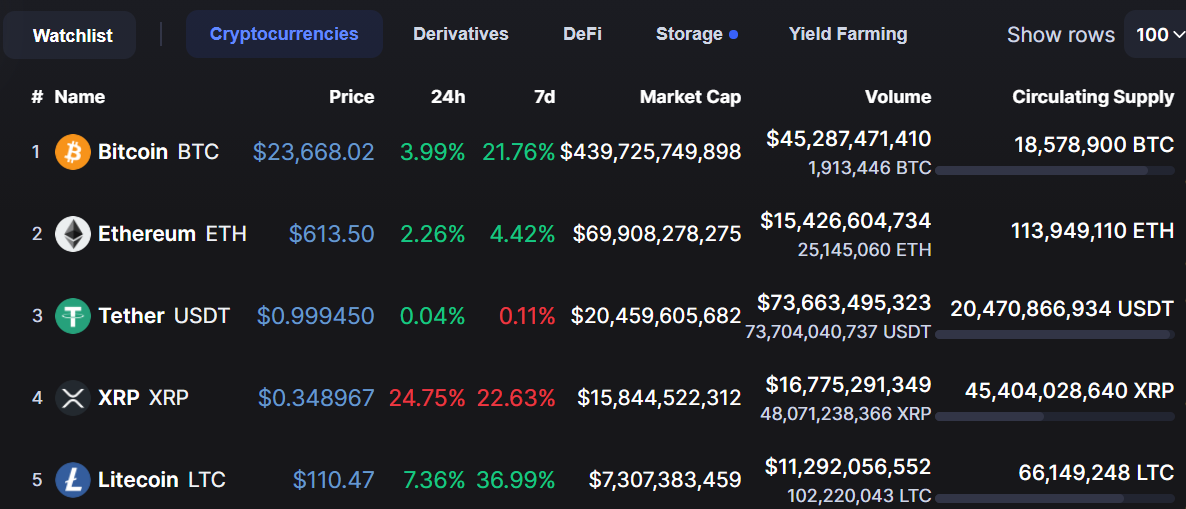

- Bitcoin: an open-source, decentralized peer-to-peer digital currency.

- Ethereum: an open-source platform for decentralized applications. Ether is the native cryptocurrency of Ethereum that can also be outside of this network like Bitcoin.

- Tether: Tether is a stablecoin, a special kind of cryptocurrency that aims to shield users from price volatility by maintaining a constant value while still acting as a digital medium of exchange.

- XRP: the lightning-quick and dirt-cheap version of SWIFT payments and currency exchanges.

- Litecoin: the ‘lite,’ cheaper, and faster version of Bitcoin.

Conclusion

We can easily observe that cryptocurrencies are versatile and multi-faceted, far beyond any traditional currency could be. Notwithstanding some of the disadvantages, cryptocurrencies are, by no means, a perfect solution, but they objectively offer more benefits nonetheless. It will be interesting to see whether they could eventually replace fiat money in the future.