Cryptocurrencies began as an experiment to create a decentralized payment method where no one has a monopoly. The present fiat system of currency is governed by the central banks of the respective country.

So, for example, the Federal Reserve controls the amount of US dollars in circulation. As we can see, to boost the economic growth of the US, it has massively ramped up the supply of the US dollar, which would have the inevitable side effect of devaluing it. Every US dollar we hold today would be less valuable tomorrow simply because inflation and supply will eat up its value.

This has also led to the indirect bailout of many corporations since their debt is also of much less value now. On the other hand, individuals like us will see the value of our savings drop. The idea of cryptocurrencies is to have a payment system that cannot be manipulated by a single entity like the Federal Reserve.

In fact, cryptocurrencies such as Bitcoin have only a limited supply of tokens that could ever be mined. This means supply will always remain constant, and hence, there is no chance of devaluation.

Fringe to mainstream

In the early 2010s, Bitcoin was still a fringe concept. It was used by technology geeks and people in Silicon Valley looking for experimental products. However, in the mid-2010s, the idea started picking up, and so did the value of Bitcoin. The price appreciation brought in more people who started a virtuous cycle. The underlying concept of blockchain is a remarkable invention, and it did not take people a lot of time to realize that blockchain and cryptocurrencies are game-changers.

The late 2010s not only saw a meteoric rise in the price of cryptocurrencies but also saw the creation of different ones as well. In fact, major institutions too started recognizing their importance. Leading investment banks such as Goldman Sachs and JP Morgan, after initially rejecting the concept, started dedicated desks to trade cryptocurrencies.

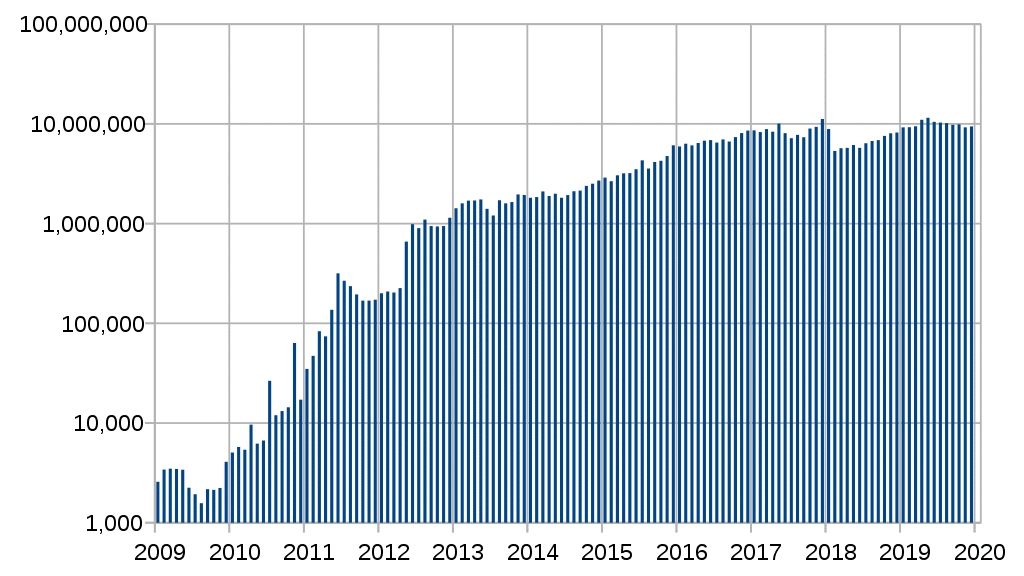

This meant that the number of transactions on the network exploded. As can be seen in the chart above, the monthly transactions have been rising at an exponential rate. In fact, even the above chart has been charted on a logarithmic scale in order to capture the rise appropriately.

Issues of scalability

The cryptocurrency networks were initially built, assuming a lower number of transactions. But with the rise in transactions, the time taken per transaction has also been steadily rising. On the other hand, the cryptos are no longer competing against other fringe transaction methods but in fact, are competing against mainstream payment platforms like Visa.

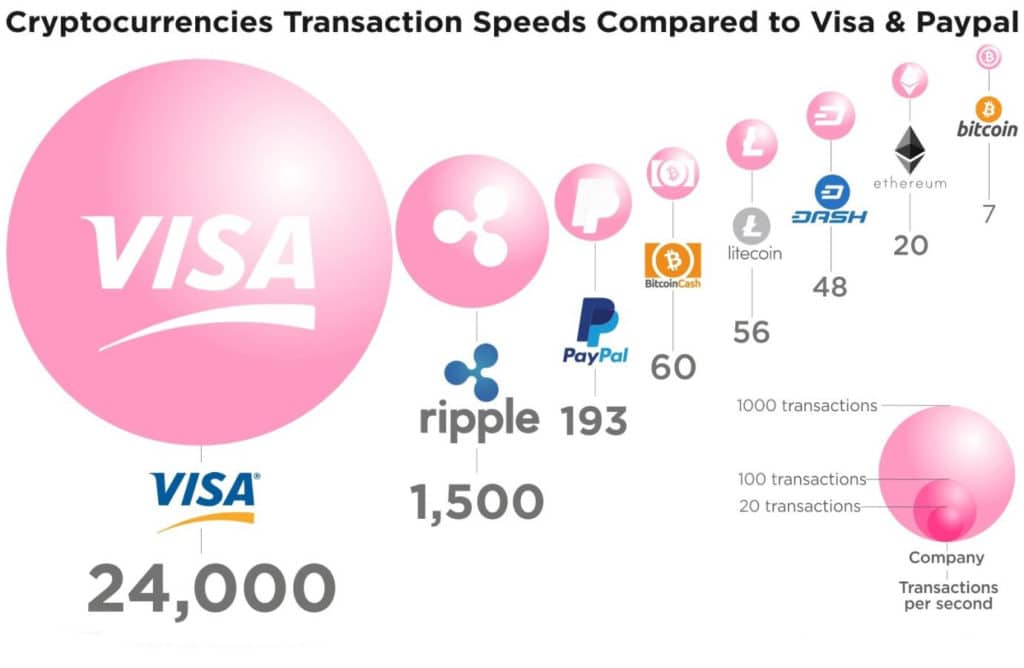

Below is a comparison chart that shows transactions per second that can be handled by each payment platform. As you can see, Bitcoin can handle only seven transactions, while Ethereum can handle 20 transactions per second. Contrast this with Visa, which can handle 24000 transactions per second. If Bitcoin and other cryptocurrencies intend to compete with these platforms realistically, they need at least to bring their transaction capacity at par with them.

The challenge here is the scale. These blockchains were initially created, keeping in mind a much smaller number of transactions. The inherent design of the blockchain means that every transaction forms a block of the chain. So, the more the number of transactions, the longer the chain gets. Additionally, validating each transaction involves analysing the entire chain as well.

The longer the chain gets, the more compute power required to validate the transaction and the more time is taken. As you might have concluded from above, the issue here is the size of the blockchain, which will keep on increasing with more and more transactions.

Sharding to the rescue

Sharding is not a new concept but something that is already used to simplify database management systems. Imagine you are running a university database that stores information about the students such as joining year, grades, etc.

Now, if all the data is clustered, to find the grades of a single student, you will have to parse through the entire dataset. But what if the data was segmented into what are known as ‘shards’ such that data of all the students of the same graduation year are saved in the same ‘shard.’ However, if the data were categorized by year, then it will be much easier to find the grades of the student by only searching in the shard of his graduation year.

This is the basic idea of sharding. Let us try to understand this in the context of blockchain. As we saw above, the key issue was the length of the blockchain. What if we split the blockchain into what is known as ‘nodes.’? Each node will independently act as another blockchain, but now the transactions will be split across the nodes. This means that the length of the blockchain will increase at a much slower pace. Now instead of just two nodes, if we create several nodes, the pace will become even slower.

By applying sharding to the blockchain, it will be possible to turn them into a far more nimble version that has the ability to handle a large number of transactions.

Ethereum is already looking to implement sharding to improve its transaction speed. The deployment of shard chains on Ethereum is a part of its upgrade to Ethereum 2. Additionally, sharding is expected to lower the hardware requirements to run a client so that it would become possible to do it on a personal computer or phone. This way, more people will be able to participate in the network.

Although sharding is no perfect solution does come with its own set of challenges. Splitting the chain implies that the individual nodes or shards become more vulnerable to takeover attempts, commonly known as shard takeovers. In such a case, a malicious set of users can convert a genuine node into a corrupted one, thus compromising the system. However, tackled correctly and safely, sharding can pave the future for a more scalable version of cryptocurrencies.