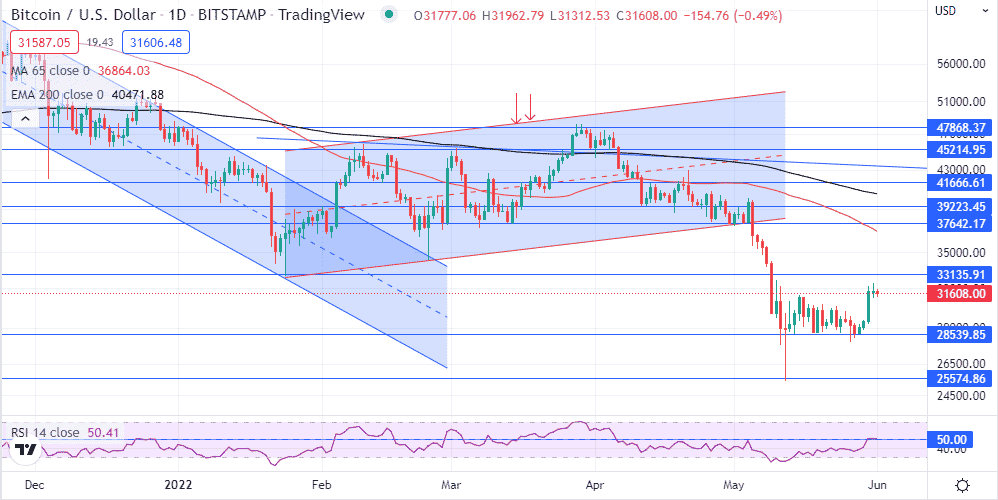

- Bitcoin finds support above $30,000

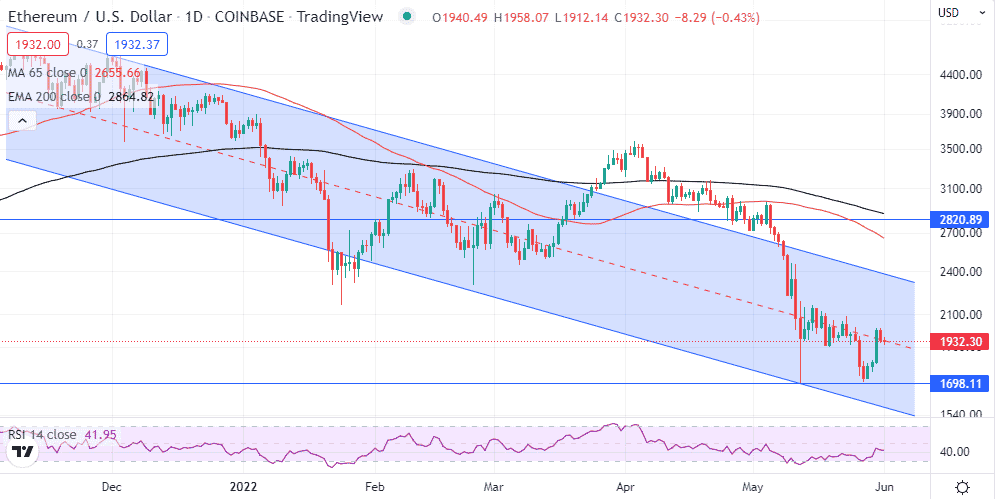

- Ethereum bulls are trying to take out the $2,000 level

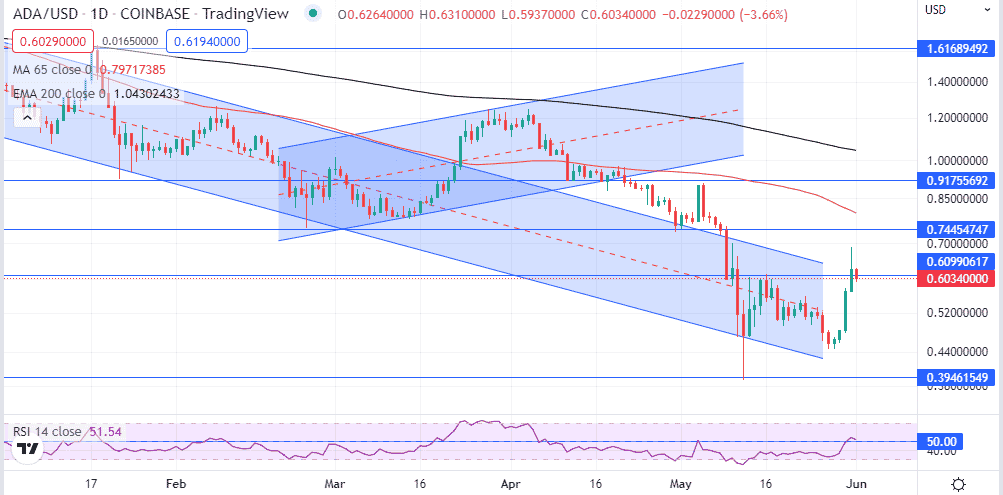

- Cardano break out looms

Cryptocurrencies are looking increasingly bullish after weeks of pounding. Bitcoin, Ethereum, and Cardano have posted solid gains this week and showing signs of breaking out after a deep pull back from record highs.

The bounce back in the crypto market has come at the backdrop of dollar strength easing. However, it is still unclear if this trend will continue even as the US Federal Reserve shows signs of aggressive monetary tightening in a bid to tame runaway inflation.

Dollar weakness is not the only factor likely to offer support to cryptocurrency bounce back. The deep pullback is increasingly making cryptocurrencies attractive on the risk-reward front. Immediate reports indicate institutional investors are accumulating positions at discounted levels.

Bitcoin bounce back

Bitcoin is one of the coins attracting solid institutional interest as the flagship cryptocurrency. The deep pullback below the $30,000 level appears to have attracted more bulls that missed out on the initial leg to all-time highs.

Consequently, BTCUSD has bounced back to highs of $31,345, waiting to see if the bulls have what it takes to defend the pivotal $30,000 handle. Above the pivotal level, Bitcoin remains well-positioned to post significant gains as traders buy the dip. However, a dip below the $30,000 level could attract more shorts sellers, resulting in the coin plunging back to 16-month lows of $25,500.

Ethereum technical analysis

Ethereum is another coin attracting strong interest from institutional investors given its growing utility around decentralized finance and the development of decentralized applications. The coin has, in recent days, powered through the $2,000 psychological but got rejected and eased lower slightly.

Failure to find support above the $2,000 level leaves ETHUSD vulnerable to further losses back to the $1700 level despite the long-term downtrend. Similarly, the coin finding support above the $2,000 level could attract more bulls on the fence as it would affirm the end of the downtrend.

Cardano growing bullishness

Cardano is another high-profile token showing signs of breaking out after months on the receiving end that resulted in it plunging below the $1 a coin level to lows of $0.39. A recent bounce back above the $0.50 level has opened the door for the coin to make a run for the $0.74 level, seen as crucial resistance level.

ADAUSD finding support above the $0.74 level would be the incentive needed to attract more bulls, resulting in the coin making a run for the $1 level.

Why are Bitcoin, Ethereum, and Cardano rallying?

Bitcoin, Ethereum, and Cardano are looking increasingly bullish amid an uptick in market risk demand. The stock market showing signs of bouncing back is the catalyst attracting investors to battered assets such as cryptocurrencies.

Some analysts believe the overall cryptocurrency market is turning the corner after months on the receiving end. For example, GlobalBlock’s Marcus Sotiriou reports that more than $87 million flowed into crypto funds over the week, a significant increase from a previous outflow of $141 million.

Capital inflows into crypto funds are an early sign that institutions and high net worth investors are increasingly buying the dip. It is also becoming increasingly clear that supply is being transferred from weak hands to long-term investors.

Bottom line

Suggestions that cryptocurrencies are trading at discounted levels is the catalyst fuelling the bounce back in the market. J.P.Morgan analysts reiterating that the fair value for bitcoin is $38,000 all but affirms why investors are increasingly going long after months of shorts. The prospect of Bitcoin, Ethereum, and Cardano edging higher from current levels is high.