- Ethereum is outperforming Bitcoin, having powered to all-time highs amid broader cryptocurrency sell-off.

- Bitcoin is under pressure on Tesla, saying it will no longer accept it as a payment option for electric vehicles.

- Dogecoin remains under pressure, having lost more than a third of its value in recent days.

Ethereum continues to outshine Bitcoin even on the broader cryptocurrency coming under pressure in recent weeks. While Ethereum has powered to all-time highs of about $4,300, Bitcoin struggles to hold on to gains above the $50,000 mark.

ETH/BTC rally

The surging selling pressure in the cryptocurrency market can be attributed to, among other things, a spike in treasury yields and a stronger US dollar. The dollar continues to strengthen across the board in the aftermath of CPI data, indicating inflation is rising much faster, something that could force the Federal Reserve to alter its monetary policy.

Amid the growing selling pressure, Ethereum continues to outperform Bitcoin. The ETH/BTC ratio has been skyrocketing in recent weeks, touching levels not seen in two years. The spike signals that traders are increasingly rotating their positions out of Bitcoin and into Ethereum.

The ETH/USD pair is up by more than 400% year to date. While it is way off from dethroning Bitcoin as the largest cryptocurrency, the gains in recent weeks suggest becoming a firm favorite in the cryptocurrency sector.

Ethereum price gains have come at the backdrop of the growing use case of its blockchain. European Investment bank is the latest to use Ethereum technology to issue $121 million in two-year digital notes. The issuance has once again underscored the growing use and credibility of the Ethereum blockchain.

In the aftermath of the issuance, ETH/USD skyrocketed to record highs of $4,370.

However, the pair has pulled lower in the aftermath of the broader cryptocurrency space coming under pressure. Rejection from all-time highs of $4,370 has seen the pair tumble below the $4,000 level. Immediate support as part of the ongoing correction is seen at the $3,400 level, from where a spike to record highs started.

Bitcoin implosion

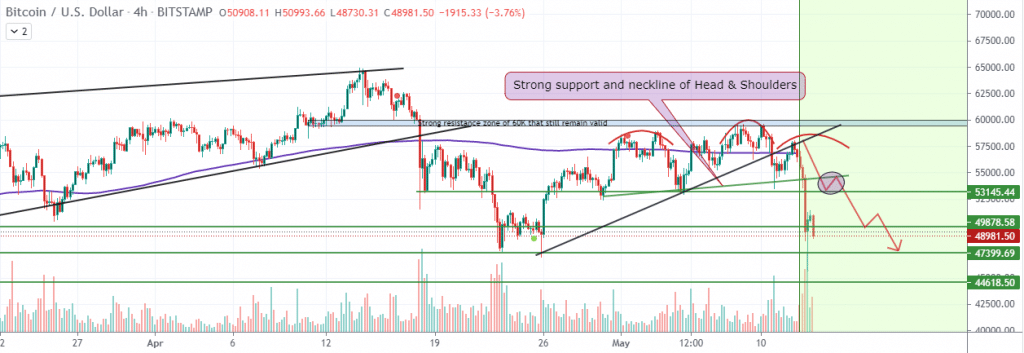

Bitcoin has not been spared either tumbling below the $50,000 level after failing to take out the $60,000 resistance level. The flagship cryptocurrency has come under pressure in recent weeks amid dollar strength.

BTC/USD has since plunged to four-week lows and is at risk of further losses owing to the strength of the downward pressure.

The pair could drop to the $44,600 level, the next substantial support level.

It is the confirmation that Tesla will no longer accept Bitcoin payments for electric vehicle purchases that have fuelled the recent implosion. Bitcoin fell by as much as 12%, as Musk cited the crypto currency’s high environmental cost as the reason for suspending it as a form of payment for electric cars.

The decision by Musk came as a surprise as it was his confirmation of Bitcoin payments a few months back that sparked a rally past the $50,000 mark and into the $60,000 territories. In February, Tesla invested $1.5 billion in Bitcoin, all but affirming the bullishness.

Dogecoin correction

Dogecoin is another cryptocurrency under immense pressure. The crypto has lost more than a third of its total value in the past few days. After powering to record highs of 0.7400 against the dollar, the ‘meme crypto’ came down tumbling in the aftermath of Elon Musk calling it a ‘hustle’ during a guest appearance on Saturday Night Live.

The coin has since touched session lows of $0.34, down by more than 35% from its all-time highs.

While the crypto has pared some of the losses, it remains under pressure amid the broader bearish pressure in the cryptocurrency space. The four-hour chart signals that the sell-off could persist. The price has already moved below the 50-day moving average. The formation of a head and shoulders pattern is another early warning sign that the momentum is the downside.