The concept of decentralization is what makes cryptocurrencies a game-changing innovation. In the past, the only way exchanges or brokerages could facilitate any traded market was primarily through a centralized order book.

Of course, many financial services still operate with this model. Fortunately, this model has been flipped on its head for a number of years as this responsibility can now be handled by your average Joe without any qualification process.

Thanks to blockchain technology, it’s now possible to foster liquidity provision peer-to-peer without any intermediary like a bank, broker, or other financial institution.

This concept is the bedrock of several DeFi (decentralized finance) applications like exchanges, borrowing/lending services, synthetic assets, and even blockchain gaming.

Presently, over $205 billion is locked in DeFi protocols across the entire industry, according to Defi Llama. Part of the driving force behind this mechanism is liquidity provider (LP) tokens, which this article will explore further.

Liquidity pools

Whether it’s stocks, commodities, or forex, any financial market needs liquidity. The definition isn’t so important in this regard because it simply means money. When you exchange US dollars to buy Bitcoin, there needs to be a party on the other side with actual BTC to sell to you.

This entity is typically a formal ‘market maker’ in a centralized exchange or brokerage. In a decentralized system, this responsibility is shifted to the users on the platform without any order book.

So, one of the solutions is using ‘liquidity pools,’ which are crowd-funded pools allocated for every market provided by a particular DeFi platform.

For example, if the service offered the ETH/USDT pair, the liquidity pool would consist of a pot of funds with Ethereum and Tether contributions from various users. To increase liquidity here, you can decide to lock your own ETH or USDT, which is where the LP token comes into the picture.

Liquidity provider tokens

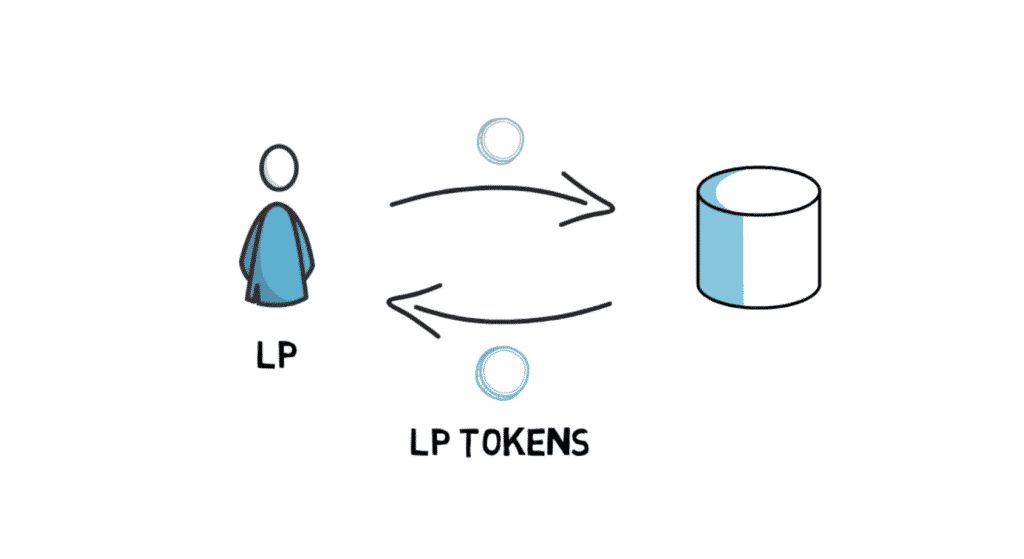

The LP token is rewarded to the providers for their efforts in providing liquidity and represents a share of that pool.

For instance, if you put in $1000 worth of ETH (where the entire worth of ETH in that pool was $10 000), you would earn 10% of that pool’s LP coins, which are made up of trading fees paid by other users swapping different digital currencies in that pool.

Such transaction costs are expressed in varying interest rates or yields based on the number of trades and the available liquidity.

LPs have the freedom to withdraw their original deposit assets away from the pool back to their wallets and keep the LP tokens as well.

Automated market makers

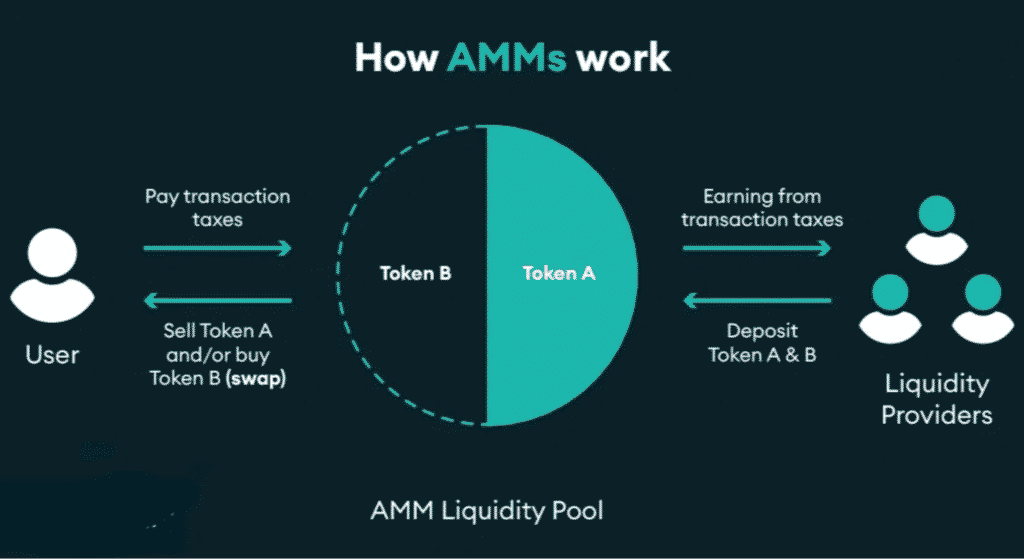

A key component in this peer-to-peer form of liquidity provision is automated market makers (AMMs). As the name suggests, this model trustlessly creates a market using a mathematical formula.

Because there is no traditional order book, this is where the AMM comes in, which is governed by smart contracts. This ensures that you don’t need any counterparty to conduct a transaction.

In other words, a buyer doesn’t need to interact with a seller at any point; only that enough liquidity exists within a pool. AMMs are primarily responsible for setting prices and distributing these tokens.

For the former, various formulas exist, the most common of which (used by the likes of Uniswap) is x * y = k. Here, x and y represent each token within a trading pair, while k is a fixed constant of the available liquidity at all times.

An AMM also algorithmically governs the token distribution based on each user’s share in the pool. The AMM will ‘mint’ the LP coins when users add funds to a pool.

Above is a simple graphic illustration to show how AMMs work.

How liquidity provider tokens enhance DeFi services

LP coins have opened up a whole world of earning passive income in DeFi through what is known as ‘yield farming.’ As previously mentioned, LPs receive interest based on a prescribed annual percentage yield (APY).

For instance, a DeFi protocol may offer a 5% APY by depositing LINK (Chainlink) into a designated pool. This would be in the form of an LP token, which is essentially an extra LINK. If you held your assets in this pool for 30 days, the total interest would be 0.4% (5% divided by 365 days X 30 days).

Aside from the incentive, LP tokens are beneficial for increasing liquidity. Before, ‘staking’ your cryptocurrencies in any DeFi platform meant that you had no access to those funds.

Generally, most staking programs ‘lock’ up your digital assets for a fixed period, meaning you cannot use your coins for other things in the meantime.

Of course, this results in lower liquidity or less money in the system. Yet, while providing liquidity, you also receive LP tokens that can be utilized for other purposes, including even being used in other unrelated DeFi services.

Therefore, you can have your cake and eat it too. Yet, providing liquidity is not a ‘piece of cake,’ primarily because of impermanent loss.

This describes the potential risk where the value of your deposit assets may negatively change when you withdraw them at a later stage because of price volatility. Thus, there is always the possibility of having less money than you started with.

Final thoughts

Of course, there are several methods of mitigating the danger of impermanent loss because, ultimately, liquidity providers are essential in DeFi to help maintain an efficient system of transactions.

Services in this realm have allowed anyone to pretty much become ‘the house’ by providing liquidity, a responsibility that has traditionally been reserved for centralized corporations.

In this way, users can cut out the middleman and have an opportunity to earn passive income while contributing to the vision of making finance genuinely decentralized.