When Satoshi Nakamoto published the white paper in October 2008, coining the term ‘Bitcoin,’ the world had little idea how revolutionary it was. Bitcoin’s ledger started operating in January 2009, and the cryptocurrency came into existence.

For several years it remained on the fringe, being used only by fintech geeks or outcasts. However, from 2013 onwards, Bitcoin started gaining more and more traction. The concept wasn’t just bouncing around in the tech circle anymore but was percolating to the larger world.

It was around this time that people realized that Bitcoin wasn’t just a digital currency. It was in fact an application of blockchain, the underlying technological concept. This was when creators started conceiving the idea of newer cryptocurrencies. These new tokens would still use blockchain technology but would attempt to overcome some of the shortcomings of Bitcoin.

Vitalik Buterin was one such programmer looking to create a new crypto token. In 2013, he proposed the idea of a new cryptocurrency called Ethereum. This token would be used not just as a digital currency but also for storing computer code. Ethereum’s development was crowdfunded, and it went live in July 2015. The token started with an initial supply of 72 million coins.

Bitcoin – the OG

Obviously, being the first cryptocurrency has its advantages. Bitcoin’s intention was to be a store of value and a digital currency, and it still remains the same. For this purpose, Bitcoin has a finite supply of 21 million tokens. So, there is no chance that more tokens would be created, which would eventually lead to the depreciation of BTC. Since Bitcoin is the earliest cryptocurrency and is meant as a financial transaction instrument, many financial institutions have recognized it officially.

Some funds have launched ETFs tracking BTC and inverse Bitcoin ETFs, while others have set up dedicated trading desks. Tesla had started accepting Bitcoin as a payment method before it was revoked due to concerns over energy consumption. In fact, very recently, El Salvador became the first country in the world to recognize Bitcoin as legal tender. This has given more and more credibility to the token, and to date, it remains the largest cryptocurrency by market cap.

What does Ethereum bring to the table?

When there is already a successful and well-established cryptocurrency, why is there a need for another one? Ethereum is not just a currency; it is a platform that enables smart contracts and the deployment of decentralized applications. Ethereum has its own programming language that runs on a blockchain.

The concept turned out to be so successful that several developers have built their applications on this platform. Ethereum’s key token, known as the ERC-20, has in fact become the standard for all smart contracts. Several other cryptocurrencies have used ERC-20 as their base protocol.

What is The Flippening?

There is a raging debate going on between Ethereum and Bitcoin cryptocurrency enthusiasts. A section backs BTC as the primary cryptocurrency, while others consider ETH as superior. As we saw above, both were built for different purposes. But as several applications of blockchain emerged, each cryptocurrency has tried to make several tweaks so as to serve the needs of all the users.

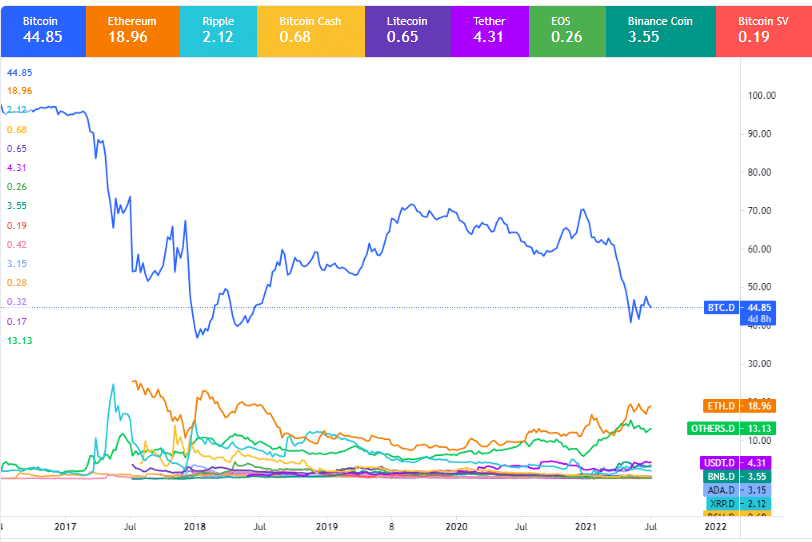

Now, the term “Flippening” refers to the hypothetical moment of Ethereum (ETH) overtaking Bitcoin (BTC) as the biggest cryptocurrency. This means that the total value of all the Ethereum existing all over the world will exceed the total value of all the Bitcoin. At the time of writing, Ethereum’s market cap is about 40% of Bitcoin’s market cap. But as you can see below, the gap has been rapidly closing over the past few months.

Ethereum backers see ‘The Flippening’ as the ultimate victory. Gaining the highest market cap among all the cryptocurrencies would indeed reflect acceptability from the users. But doing so by dethroning the incumbent and oldest cryptocurrency would be a difficult feat. As mentioned above, ETH’s market cap is 40% of BTC which means that it will have to grow by two and a half times to catch up. That is an uphill task indeed.

However, several users are of the view that the crossing of the market cap is not the only mark of ETH’s dominance. There are several other measures that are representative of which cryptocurrency is more widely accepted by users across the globe.

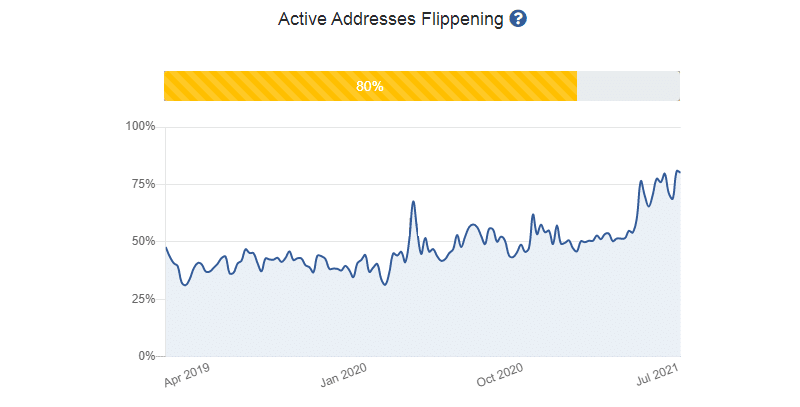

Many users see active addresses as a more pertinent measure. Active addresses for a cryptocurrency stand for the number of unique addresses that transact in the token in a given week. As can be seen below, the ratio of active addresses for ETH to active addresses for BTC has risen steeply over the past few months and is at 80%. So The Flippening, in fact, might be much closer than what the market cap data would suggest.

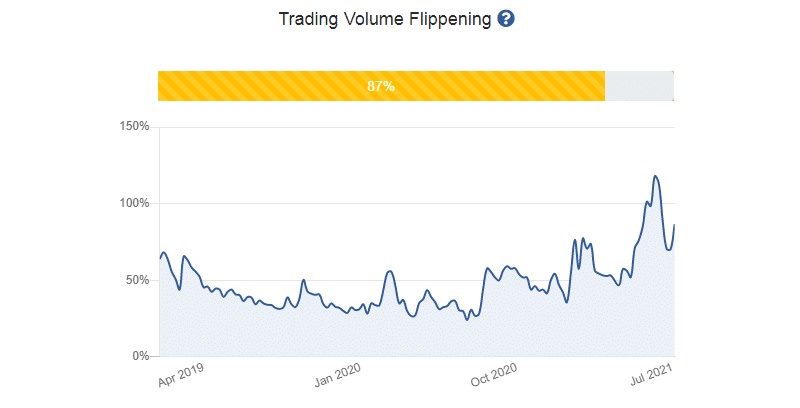

Another relevant measure would be the trading volume or transactions volume. Trading volume represents the number of tokens traded on the exchange for a particular token. This reflects how often users are buying or selling the token. As can be seen below, Flippening had already happened last month for this measure. Trading volume for ETH briefly exceeded that of BTC, although the ratio has fallen back and is currently at 87%.

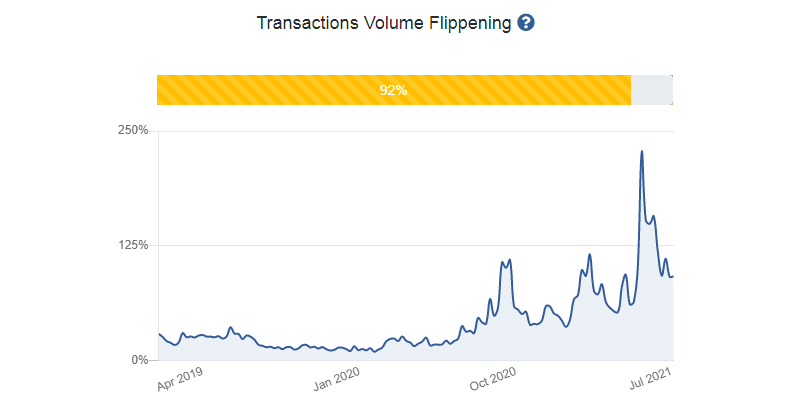

Along similar lines, transaction volume represents the total amount of USD that gets sent over the network. As seen below, for this measure as well, Flippening already happened last month, and the ratio too fell back and is currently at 92%.

No matter how you define ‘The Flippening,’ it is beyond doubt that ETH has steadily gained more and more influence. The cryptocurrency is large enough for two dominant tokens to existing at the same time, especially when they both offer different functionalities. However, ‘The Flippening’ does reflect the preference of users and the market cap Flippening would be a shot in the arm for ETH.