Cryptocurrencies are very volatile in nature. It is not uncommon for a coin to spike or plummets 10%, 25%, or more in a span of a few minutes. This is a double-edged sword, as it provides investors with unique profit opportunities and a high risk of loss. For investors with a diversified crypto portfolio, it may be difficult to keep track of the performance of each of their assets in real-time. To remedy this, most prefer to use crypto portfolio trackers. These are platforms that enable the tracking of several cryptocurrencies on one interface.

Why you need a portfolio tracker

- They help you set realistic financial goals – the tracker helps you easily track the value of your holdings and whether you’re making losses or profits at the current rate. This can help you set achievable financial goals and take appropriate measures to hit them.

- Helps you tell the value of your holdings in real-time – Due to the fluctuating nature of crypto prices, manually calculating the value of all your holdings at any one time may be an exercise in futility. Their values will have changed by the time you’re done, necessitating you to start over. A portfolio tracker does this automatically, and it only takes a glance to find out the value of your holdings.

- Helps capitalize on trading opportunities – In the crypto market, ideal trading opportunities are often short-lived. Therefore, once you spot one, it is vital to act quickly in order to reap maximum profits. A portfolio tracker helps you determine your buying power at any time, helping you best capitalize on these opportunities.

- Helps in portfolio diversification – The main issue with portfolio diversification is losing track of your various holdings. With a portfolio tracker, you can easily see how much of what coins you hold. This can also help you determine where you’re exposed to risk and take measures to hedge against it.

Best Crypto Portfolio Trackers in 2022

Pionex

Pionex is, first and foremost, a crypto exchange. Among its several features are several trading bots and a portfolio tracker. This means that users of this platform can automate their whole trading experience and keep track of their performance from the portfolio tracker. Pionex also enjoys a close partnership with Binance and Huobi, ensuring constant liquidity.

You can access the platform from your browser, where you can enjoy transaction fees as low as 0.05%. You can also choose from a variety of bot types, from the grid and spot-futures arbitrage to DCA bots. Pionex is also licensed by FinCEN.

CoinSmart

CoinSmart is another exchange that features a portfolio tracker amongst its breadth of offerings. It supports all popular cryptocurrencies on its desktop and mobile app. You can link your bank account to the platform for easier purchases, or you could use debit/credit cards, wire transfers, and e-transfers. It also features a wallet, where you can hold and track your holdings with ease. From the wallet, you can track your total balance as well as your balance per crypto coin. You can also view your trading history on its intuitive interface.

Koinly

This is a portfolio tracker that also doubles as a tax calculator. It is available in more than 20 countries, and from these, it can generate a comprehensive tax report in under 20 minutes. What’s more, Koinly gives you insights on how better to perform your transactions for tax benefits. Using its AI algorithms, it also generates recommendations of potential trade setups.

Koinly is compatible with over 350 exchanges and 50 wallets. You can connect these using API, after which the platform will generate your tax reports, trade history as well as yearly profit and loss reports.

Coin Market Manager

This is a crypto analytical tool that helps keep track of your trading through journals. It generates a journal of all your transactions, helping you better gauge the performance of your portfolio. This can be helpful as it can inform you about past mistakes, successes and where there’s room for improvement. You can also create a watchlist for certain trends and any changes to them so that you better time your trades. Coin Market Manager also allows you to create a public page with a URL that you can share with others to verify your portfolio and trade history.

What’s more, the platform offers a 14-day free trial, after which you would have to subscribe to their paid tiers. The Professional package costs $500 annually, while their Enterprise package will set you back $600 every year. You can also opt for their monthly memberships.

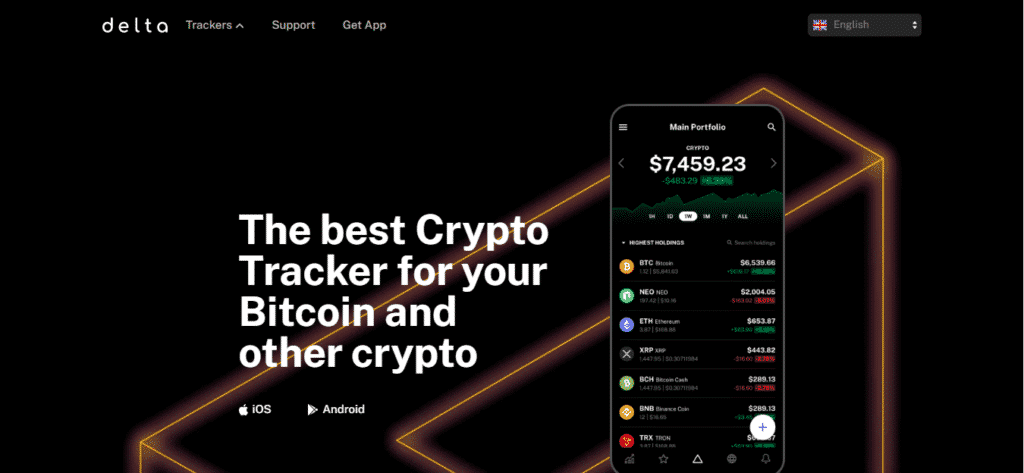

Delta Exchange

Delta is a crypto exchange that features an intuitive portfolio tracker. On it, you can trade derivatives, stablecoins, and other crypto tokens. The platform is regularly updated, which enables users to trade futures, options as well as interest rate swaps. They also offer leverage of up to 1:100.

Notably, withdrawals from Delta are manually reviewed to ensure no foul play. This is in addition to their state-of-the-art security for all your connected crypto wallets. They also charge low trading fees, at 0.02% for the maker and 0.05% for taker orders.

Conclusion

In crypto, as in all investing, it is always prudent to diversify your portfolio. However, this brings about the issue of tracking the performance of all your assets in real-time due to the highly volatile nature of cryptocurrencies. To that end, there are several trackers in the market today, some of which offer additional features such as tax calculators and a built-in exchange. You cannot go wrong with any of the choices we’ve discussed, or even a combination of them.