- ETHUSD down 40%

- Ethereum starts to bottom out

- Ethereum blockchain competitive edge

Cryptocurrencies have been in a downtrend for the better part of the past four months. Bitcoin and Ethereum have shed more than 40% in market value. While the sell-off is a point of concern, it also presents a buying opportunity at a discount.

ETHUSD technical analysis

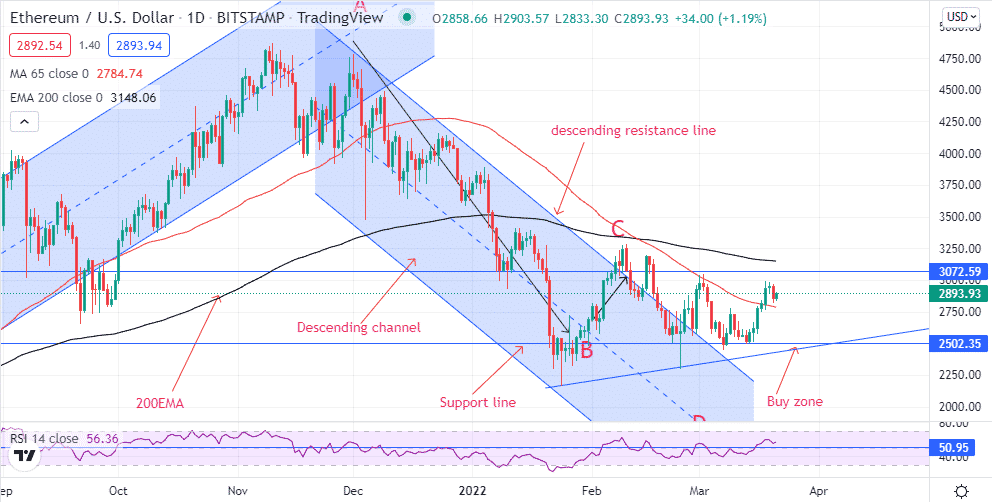

Ethereum is one of the coins that provide tremendous opportunity on the risk-reward front. After a 40% pullback, the second-largest cryptocurrency by market cap has started showing signs of bottoming out. The $2,500 level has emerged as a good support level from where ETHUSD has started edging higher amid a buildup in buying pressure.

A rally to the $2,800 level has opened the door for bulls to steer a rally to the elusive $3,000 psychological level. A rally followed by a close above the $3,000 mark would re-affirm the bounce-back spree, setting the stage for ETHUSD to make a run for all-time highs.

On the flip side, failure to rally and find support above the $3,000 level would leave ETHUSD susceptible to a pullback, back to the $2,500 support level. However, the Relative Strength Index rising above the 50 handle signals a buildup in buying pressure, signaling that bulls are in control.

Improving risk-on mood

Dust slowly settling in the broader cryptocurrency industry with the sell-off pressure easing continues to support a bounce back in the broader industry. A bounce back in risk-on mood in the broader capital market is another factor that affirms the prospect of ETHUSD rallying after a recent bounce back.

Stocks have in recent weeks bounced back after weeks of sell-offs. Investors taking advantage of highly battered investments appear to be fuelling a buying spree in the cryptocurrency market as well. Stocks and cryptocurrencies have been trading in tandem, which explains why Ethereum has rallied as the US major stock indices rallied.

Ethereum’s blockchain competitive edge

ETHUSD recent price rally has everything to do with the Ethereum’s blockchain growing competitive edge. Amid stiff competition, Ethereum has stood out as an ideal platform for the development of smart contracts and decentralized applications (dApps), emerging as a preferred choice for developers.

Increased Ethereum blockchain use from hosting non-fungible tokens to acting as a marketplace for decentralized finance applications, among others, has continued to fuel demand for Ether coin. In addition, the programmable nature of the blockchain also makes it a strong player in the burgeoning metaverse sector.

Amid the Ethereum blockchain use, it is the latest upgrade that continues to strengthen its competitive edge and long-term prospects. For the longest time, the network has struggled with sluggish transaction times and high fees.

A proposed update to the proof of stake model is expected to enhance Ethereum’s network capability in handling more transactions per second. Currently, the blockchain can only handle 14 transactions a second. Following the proposed upgrade, it is expected to handle up to 100,000 transactions per second.

An increase in the number of transactions that the network can handle should lead to increased demand for the ether coin, which in return should result in price appreciation.

Final thoughts

There is no doubt that ETHUSD has been battered significantly over the past few months. While the short-term outlook remains bearish, its long-term outlook remains bullish. The volatile nature of cryptocurrencies means Ethereum has what it takes to bounce back after the 40% pullback.

Increased blockchain adoption is one of the factors that should support Ether price appreciation given the increased use of the Ethereum blockchain in hosting dApps, smart contracts, and non-fungible tokens.