- Cryptocurrencies correct lower.

- Ethereum is down 10%.

- What are Ethereum long-term prospects?

Cryptocurrencies are under pressure as investors react to the hawkish stance of the U.S. Federal Reserve. The central bank has hinted at a 50-basis point hike as the need to act aggressively to combat runaway inflation increases. The hawkish stance is the catalyst fuelling dollar strength, all but pilling pressure on cryptocurrencies which have been in a recovery mode over the past month.

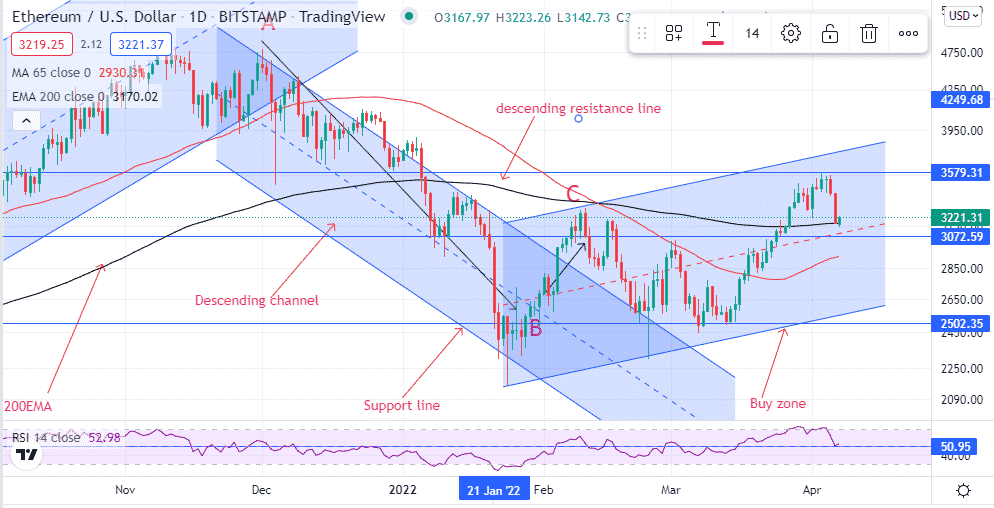

ETHUSD technical analysis

Ethereum is one of the coins under pressure going down by more than 1% on Wednesday as the broader cryptocurrency sector corrected lower. This week alone, Ethereum has lost about 10% in market value from two-month highs. ETHUSD has since pulled back to the 100-day moving average, waiting to see if it holds above the key level.

The $3,170 area has emerged as the short-term support level where ETHUSD remains well supported for further upside action. A daily close below the key level could trigger renewed sell-off that could see the pair correcting to the $3,000 handle.

On the other hand, the $3,573 is the immediate short-term resistance level. Bulls have struggled to steer a rally above the key level, resulting in the recent correction lower. A daily close above the resistance level should reaffirm the emerging uptrend setting the stage for Bitcoin to make a run for the $4,000 handle.

The Relative Strength Index is currently trading above the 50 level. What this means is that bulls are still in control despite the recent pullback from the $3,500 area. The RSI closing below the 50 handle could signal a buildup in short-sellers in the market, something that could result in further losses.

Why Ethereum is tanking

Ethereum and other cryptocurrencies are under pressure as investors turn their attention to high yield investments in response to the hawkish stance of the Federal Reserve. Minutes from the March meeting indicate that many FED participants are inclined to raise interest rates by 50 basis points to curtail inflationary pressures.

The hawkish stance by the FED continues to fuel a rally on yields, with the US treasury bills ticking up as non-yield assets such as Ethereum and other cryptocurrencies continue to tick low. While Ethereum remains under pressure amid concerns about the Federal Reserve monetary policy, its long-term prospects remain intact.

Ethereum has grown to become a dominant force in decentralized finance. As much as 70% of DeFi apps already run on the Ethereum blockchain. While some projects have eaten into its DeFi market share in recent years, its blockchain is about to get even better.

Ethereum big switch

Ethereum is in the process of switching from a proof of work to a proof of stake system. The transition will make its blockchain much faster, more efficient, and cheaper than it is now. The upgrade is also expected to address the congestion issues that have affected its adoption.

Proof of stake protocol should enhance the mining process and lower the congestion for getting new coins mined. In addition, it should make the Ethereum blockchain faster with lower transaction fees. Such improvements should make it an ideal platform for developing smart contracts and decentralized applications.

Final thoughts

Increased use of the Ethereum blockchain for smart contracts, decentralized applications, and DeFi is an advantage that should trigger strong demand for the native token Ether. Ethereum has lots of potential in the coming years as its use cases continue to increase. Consequently, its price is expected to increase despite the recent pullbacks.